Tax Instalments

If you are a Sole Proprietor required to make tax instalments, they are due March 15, June 15, September 15 and December 15.

Corporate owners see their instalments due either monthly or quarterly; when quarterly, they are due within one month after the end of each of your fiscal quarters.

Instalments can cause confusion for people, especially when falling under the rules for the first time. In this newsletter, I’m going to share briefly what the instalment program is, how it works, when you might find yourself subject to it, and what your responsibilities are.

✅ WHY INSTALMENTS?

The Canada Revenue Agency is pretty good about ensuring they get their tax revenue in on a timely basis. If you are an employee, you’re often paying your taxes without fully experiencing it. Your employer is withholding that money from your paycheck every time they pay you and then submitting it, along with the premiums for the CPP and EI programs, on a regular basis.

When income tax season comes in the spring, you then go through the process of figuring out how much taxable income you earned in the prior year, what tax deductions you have to offset that income, and how much you owe in taxes for the year. You’ll get credit for those taxes that you’ve already paid via your employer or if you had other income sources that were withholding tax at source. If you have not prepaid enough tax, you have an amount due with your tax return; if you paid more than you were required to, you will get a refund.

That’s the regular process for most people that are earning as employees in Canada.

For those of us who have businesses, we don’t generally have somebody else figuring out for us how much tax we need to pay and remitting those amounts for us to CRA. Instead, that’s up to us!

And this is why I have conversations every tax filing season with brand new entrepreneurs who are going through this process for the first time and realizing just how much tax we pay in Canada. Some of them have saved enough, but some of them have not, and the latter situation isn’t fun!

The first year of being in business, you get a little bit of a break – you don’t have to pay the taxes owing until after the tax year is completed and you are doing these calculations. For Sole Proprietors, your deadline to pay your income tax is April 30th for the prior year’s income; for most incorporated businesses, taxes are due three months after your fiscal year-end (some corps only have 2 months to pay, so check your corporation status).

CRA doesn’t like this plan going forward; they would prefer their tax revenue to be paid more frequently than a few months AFTER the year you’ve earned it. This is where the tax instalment program comes in; it’s a way for CRA to get their tax revenues in a timelier fashion.

✅ WHEN ARE TAX INSTALMENTS REQUIRED?

Instalments can apply to any tax account you have, including the GST/HST program, corporate tax, and personal tax. If you owed more than $3,000 on your last tax return, AND if you are going to owe more than $3,000 on your next return, then you are required to make quarterly instalments. Once you’ve hit this pattern two years in a row, CRA is going to start mailing you every year to remind you that you’re required to pay instalments, and providing a remittance amount on the slip.

The amount on their mail-out is not necessarily the correct amount, because CRA is assessing this amount based on your past filings – if you are having a more prosperous year, you are going to end up owing more than is listed, and if your profit is lower than the prior year, then you would actually owe less. As long as you pay what’s on your remittance slip, you will not get hit with interest charges. Or if you pay LESS but estimate and pay the correct amount, you also will not get hit with interest charges.

✅ WHAT HAPPENS IF YOU DON’T PAY THEM?

Anytime your taxes are paid late, CRA is going to charge you interest at the prescribed rate. At the time this article is published, the prescribed rate is 7% (see the current and recent historical rates HERE). The interest is calculated on the difference between what you should have paid vs what you actually paid. Any interest charged by CRA is NOT tax deductible (as opposed to the interest on a loan or your business credit card, which you can claim as an expense.)

✅ HOW DO YOU KNOW HOW MUCH TO PAY?

The easiest option, if you are receiving the CRA mailouts, is just to pay the amount on the slip! There are no extra calculations on your behalf, and if you want simplicity, just do that.

But it might not be the correct amount…

And if you are just hitting the requirement for the first time, then you won’t be receiving these mailouts yet; CRA generally doesn’t start sending these until after you’ve filed two returns.

If we want the benefit of having our numbers work for us, not just to pay taxes, but to guide our decision-making, then we are better off doing that bit of work to estimate what we actually owe and remitting that amount. Even for the brand-new entrepreneurs, I would recommend that you start doing this NOW, even if you’re in your first year of operations. This will ensure you won’t be in the uncomfortable position come filing time of having a bigger-than-expected tax bill.

To calculate this, you’re going to need to have your bookkeeping up to date, or at least estimable, as you will need to extract the profit from your past three months. Remember, you pay taxes on the profit, not the total revenue – your profit is what remains after you subtract all of your business expenses from your revenue. Once you have calculated your profit for the quarter, you are simply going to multiply it by the tax rate you are in.

If you’re incorporated, this is pretty easy because the rate is the same across the board until you exceed $500,000.

For Sole Proprietors, you will have to use a blended rate because your income taxes are calculated on the marginal personal tax rates. If you are experiencing similar earnings to the prior year, you can take the percentage from last year: just divide the total taxes by the total taxable income reported on your T1.

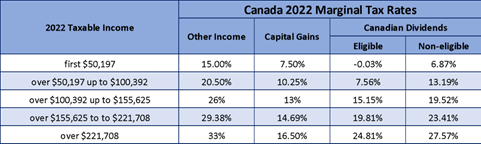

If your current year is significantly different from the prior year, you will have to do some extra calculations. The federal rates are shown here:

You will also need to add your provincial rate ON TOP of the federal rate. Since we have so many provinces in Canada, easy-to-read charts showing all provinces don’t really exist, but you can find the marginal rates for your province HERE.

If you’re brand new in business, for a very rough guide, I recommend saving 25-30% of your profit to pay toward income tax and CPP, depending on which province you’re in. If you are very low income, you can get away with a little less; conversely, if you’re over six figures, you need to save more and perhaps consider incorporating (but that’s a topic for another day!)

When it comes to your GST/HST remittances, you’re going to either:

- Rely on your up-to-date bookkeeping and remit the net owing, or

- Take your total collected, subtract a reasonable estimate of what the tax paid on your eligible expenses would be and remit the net balance (remember that any GST/HST paid on business expenses are deductible as ITC’s on your GST/HST return)

I hope this has provided you with a better understanding of how to break all this down and approach your current instalment plan or prepare yourself for your remittance come filing time. We spend a lot of time in my online course going through these kinds of details, and with our year-end clients, we will always do that analysis with them. If you’re looking for extra support in this area, please reach out!

Or you can join our FREE Facebook Group, where you can ask questions and seek advice or recommendations from your fellow business owners and ME!